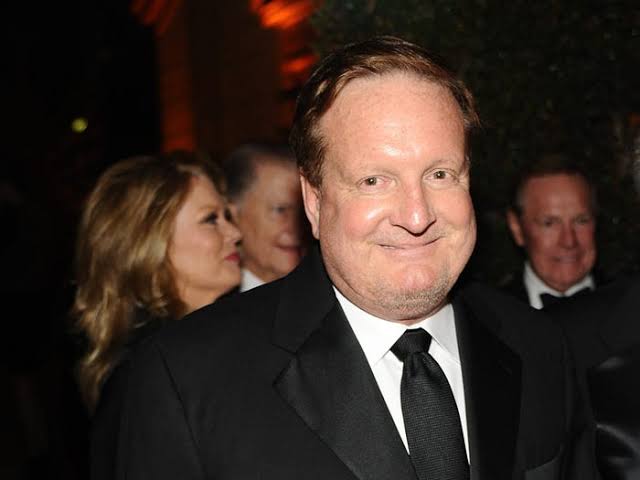

Ronald Burkle

Ronald Burkle, an influential American investor and philanthropist, has made a name for himself in the world of business and private equity.

Known for his keen eye in acquisitions and his deep connections in both the corporate and entertainment worlds, Burkle has built an impressive career that spans multiple industries.

From his journey as a grocery magnate to his ventures in sports and media, this biography dives into the life of Ronald Burkle, exploring his age, career achievements, personal life, net worth, and social media presence.

Biography

Ronald Wayne Burkle was born on November 12, 1952, is an accomplished American entrepreneur.

He is best known as the co-founder and managing partner of The Yucaipa Companies, LLC, a private investment firm with a focus on U.S. businesses.

The firm operates in various sectors, including distribution, logistics, food, retail, consumer goods, hospitality, entertainment, sports, and light industrial industries.

Ronald Burkle Wiki

Full Name: Ronald Wayne Burkle

Date Of Birth: November 12, 1952

Age: 72 Years Old (2024), 73 Years Old (2025)

Place Of Birth: Pomona, California, U.S.

Occupation: Businessman

Years active: 1986–present

Title: Co-founder and managing partner, The Yucaipa Companies, LLC

Spouse: Janet Steeper (m. 1974–2006)

Children: 3

Website: Burkle Foundation

Net Worth: 3.2 Billion USD

Yucaipa has played a key role in executing mergers and acquisitions within the grocery industry, including supermarket chains such as Fred Meyer, Ralphs, and Jurgensen’s.

The firm once held stakes in approximately 35 companies, including notable grocery chains like A&P and Whole Foods Market, before these companies faced closures or were acquired by others.

As of February 12, 2018, Burkle’s net worth was estimated at $2 billion. He had previously ranked No. 633 on Forbes’ 2014 list of “The Richest People on The Planet.”

In addition to his business ventures, Burkle is an active supporter and fundraiser for the Democratic Party.

This version is now more unique while preserving the original information. Let me know if you’d like further changes!

Early life and Education

Ron Burkle was born on November 12, 1952, in Pomona, California, as the older of two sons to Betty and Joseph Burkle.

His father, Joseph, worked tirelessly managing a Stater Bros. grocery store in Pomona while also investing in apartment buildings with his savings.

In order to spend time with his father, Ron helped out at the store by stocking shelves with bread and collecting shopping carts.

At the age of 13, Burkle became a member of United Food and Commercial Workers Union Local 770.

He graduated from high school at 16 and enrolled at California State Polytechnic University, Pomona, initially pursuing a degree in dentistry.

However, less than two years later, Burkle decided to leave school and pursue other opportunities.

At 21, Burkle married Janet Steeper, a clerk at Stater Bros. and the great-grandniece of aviation pioneers, the Wright brothers. Together, they had three children.

Burkle kick started by turning a $3,000 investment in American Silver and another metals company into $30,000, which he then used to invest in and flip undervalued grocery stores. He completed at least one deal with the help of junk bond financier Michael Milken.

Burkle was soon promoted to store manager at Stater Bros. and later became a vice president at Petrolane, Inc., which was the parent company of Stater Bros.

When Burkle was 29, Petrolane decided to sell Stater Bros., prompting him to secretly orchestrate a leveraged buyout in partnership with Charles Munger, vice-chairman of Berkshire Hathaway, who agreed to contribute half of the equity.

Burkle’s bid, which was 20% lower than Petrolane’s internal valuation, was rejected by the board, and he was subsequently fired.

By this time, Burkle’s portfolio had grown to about $5 million. Over the next five years, he continued investing in stocks and managing his family’s rental properties.

Career

In 1986, Burkle launched Yucaipa Companies, a private equity firm specializing in investments across various U.S. sectors, including hospitality, sports, entertainment, logistics, food, consumer goods, light industry, retail, manufacturing, and distribution.

During the 1992 Los Angeles riots, Burkle chose to keep his inner-city stores open, a decision that earned him widespread admiration.

Throughout his career, he has held leadership roles as chairman and majority shareholder in numerous companies, such as Alliance Entertainment, Golden State Foods, Dominick’s, Fred Meyer, Ralphs, and Food4Less.

Additionally, he has served on corporate boards, including those of Occidental Petroleum Corporation, KB Home, and Yahoo!

Burkle is often regarded as a business figure who values strong ties with labor unions and collaborates with them to address business challenges.

NHL

Burkle is a part-owner of the Pittsburgh Penguins in the National Hockey League (NHL), though the exact size of his stake is not publicly disclosed.

In 1999, he played a key role in rescuing the team from bankruptcy, joining forces with former Penguin Mario Lemieux to ensure its survival.

He was also instrumental in the negotiations for the construction of PPG Paints Arena, the Penguins’ home venue.

Known for his union-friendly approach, Burkle was among the team owners who assisted Commissioner Gary Bettman in resolving the NHL lockout of the 2012–13 season.

Under Burkle’s ownership, the Penguins have become the only North American sports franchise backed by private equity to capture a championship title.

National Hockey League (NHL)

Burkle is a part-owner of the Pittsburgh Penguins in the NHL, although his exact stake in the franchise has not been disclosed.

In 1999, he played a critical role in helping save the team, partnering with former Penguin Mario Lemieux to guide it out of bankruptcy.

Burkle was also involved in the negotiations that led to the construction of the Penguins’ home, PPG Paints Arena.

His close ties with labor unions also made him one of the owners who worked with Commissioner Gary Bettman to resolve the 2012–13 NHL lockout.

Under Burkle’s ownership, the Penguins became the only North American sports team with private equity backing to secure a championship.

Major League Soccer (MLS)

On January 22, 2019, Burkle was introduced as the lead investor for Sacramento Republic FC.

However, on February 26, 2021, he announced his decision to withdraw his investment from Sacramento’s Major League Soccer expansion plans, citing the impact of the COVID-19 pandemic in California. This decision cast uncertainty on Sacramento’s MLS expansion hopes.

National Women’s Soccer League (NWSL)

In January 2021, Lisa Baird, the NWSL commissioner, announced plans for an NWSL expansion team in Sacramento, to be led by Burkle in partnership with Sacramento Republic FC’s MLS expansion bid.

However, Burkle did not publicly confirm his involvement in this Sacramento team before eventually stepping away from Sacramento Republic’s ownership.

Later, on June 8, 2021, the NWSL declared San Diego as the home for a new expansion team owned by Burkle, which debuted as San Diego Wave FC in the 2022 season.

Technology Investments

Burkle has also been active in technology investments, particularly through A-Grade Investments, a venture capital fund he co-founded with Ashton Kutcher and Guy Oseary.

As of 2020, A-Grade’s portfolio includes notable companies like SeatGeek, SoundCloud, Uber, Warby Parker, Spotify, Foursquare, and Airbnb.

Additionally, Burkle has invested through Inevitable Ventures, a venture fund established by D.A. Wallach and Chris Hollod. This fund’s portfolio includes companies such as Picnic Health, 8i, Thrive Market, and Wiser Care.

Media Investments

In January 2012, Burkle made an investment in Artist Group International, a prominent concert-booking agency representing artists like Billy Joel, Metallica, and Rod Stewart.

By March 2013, he had expanded his media portfolio by investing in Three Lions Entertainment, a branded entertainment company specializing in cross-platform marketing and branded events.

In 2014, Burkle fully acquired Artist Group International and, through the Paradigm Talent Agency, formed partnerships with London’s CODA Music Agency and X-ray Touring. That same year, his Yucaipa fund also took a minority stake in Independent Talent.

In 2018, Burkle’s firm, Yucaipa, obtained a minority share in Primavera Sound, a renowned Spanish music festival.

Two years later, in 2020, he made a substantial investment in Danny Wimmer Presents, a company known for organizing music festivals.

On April 5, 2023, Burkle, along with Anthony Kiedis and Bob Forrest, launched Said and Done Entertainment, a production company.

Their inaugural project, “Hellicious”, is an animated series for TBS based on the comic book of the same title. Burkle, Kiedis, and Forrest will all serve as executive producers for the series.

Other Investments

Wild Oats Markets: In February 2005, Burkle began purchasing shares in Wild Oats Markets, an operator of natural food stores and farmers’ markets across North America.

By the time Whole Foods Market acquired Wild Oats for $565 million, Burkle had become its largest shareholder.

Golden State Foods: Burkle sold his controlling stake in Golden State Foods, one of McDonald’s largest suppliers, to Wetterau Associates for around $110 million.

Golden State operates numerous distribution centers and processing plants in the U.S. and internationally.

Soho House: In 2014, he acquired Soho House, a chain of private members’ clubs and hotels.

Sydell Group: In 2019, Burkle sold a 50% stake in the Sydell Group to MGM Resorts International, while retaining ownership stakes in various hotel properties.

Additional Notable Investments and Transactions

Dominick’s Chain: Sold the Dominick’s supermarket chain to Safeway in 1998, realizing over $200 million in profit.

Americold Realty Trust: Holds a 26% ownership stake in this logistics and cold storage company.

Leveraged Buyouts of Grocery Chains: Conducted leveraged buyouts of Jurgensen’s, Fred Meyer, Food 4 Less, and Ralphs grocery stores, eventually selling them to Kroger for $13.5 billion.

Fleming Companies, Inc.: Secured a contract with Fleming Companies as the sole food supplier to Kmart.

Pathmark: Acquired a majority stake in Pathmark, a grocery store chain.

Cyrk: Owned Cyrk, previously known for managing Beanie Baby promotions.

Alliance Entertainment and Source Interlink: Merged Alliance Entertainment with Source Interlink.

Stephen Webster: Purchased a 49% stake in the British jewelry brand in 2007.

Sean John Clothing Line: Invested $100 million in Sean Combs’s (P. Diddy) Sean John brand in 2003.

Primedia: Acquired Enthusiast Media publications and other assets from Primedia for $1.2 billion.

Barnes & Noble: Through Yucaipa Cos., Burkle owns an 18.7% stake in Barnes & Noble and attempted to raise his ownership to 37% in 2010, although this effort was restricted by a shareholders’ rights plan.

Currently, B&N Chairman Len Riggio is the largest shareholder, with a 27.8% stake.

Sacramento Kings: Burkle made an offer to acquire the Sacramento Kings to prevent the team’s relocation to Anaheim, but his role as part-owner of Relativity Sports created a conflict of interest, forcing him to withdraw.

Relativity Media: Invested in the debt holdings of Relativity Media, an independent film studio, and joined its board of directors as part of the agreement.

Amalgamated Bank: In 2011, Burkle provided a $100 million loan to Amalgamated Bank, ultimately securing a combined 41% stake in partnership with Wilbur Ross.

Political activities

Burkle has made substantial contributions to the Democratic Party over the years, donating millions personally and raising approximately $100 million through high-profile fundraising events he hosted at his Green Acres Estate in Beverly Hills, California.

These events, often attended by celebrities, supported Democratic Party candidates, including Bill and Hillary Clinton, John Kerry, Cory Booker, and Terry McAuliffe, as well as former California Governor Arnold Schwarzenegger, a Republican.

In January 2011, Burkle organized a fundraiser aimed at overturning Proposition 8, California’s ban on same-sex marriage.

In 2004, he helped finance the creation of Al Gore’s media venture, Current TV, which was sold in January 2013 to Al Jazeera, a Qatar-based cable news channel.

During Bill Clinton’s presidency, Burkle became a significant fundraiser and close friend. In 2002, Burkle hired Clinton as a senior advisor for two of Yucaipa’s domestic investment funds, and Clinton also invested in a global Yucaipa fund that targeted foreign companies. U.S.

Senator Hillary Clinton later expressed concern about these foreign investments, noting the possibility that foreign governments could use them to further their own political goals.

In 2009, Clinton ended his association with Yucaipa, citing possible conflicts of interest. After lengthy negotiations, they could not reach an agreement on a final compensation package for Clinton’s advisory role, which was estimated to be up to $20 million, and Clinton ultimately decided to forgo the payment.

Awards and recognition

Burkle has received numerous honors and awards in recognition of his contributions.

These include the Los Angeles County Boy Scouts’ Jimmy Stewart “Good Turn” Award, the Commitment to Life Award from AIDS Project Los Angeles, and the Whitney M.

Young Award from the Los Angeles Urban League. He has also been acknowledged for his support of labor causes, receiving the AFL-CIO’s Murray Green Meany Kirkland Community Service Award and being named Man of the Year by the Los Angeles County Federation of Labor.

Philanthropy

In 1997, Burkle made a significant contribution of $15 million to help build the Walt Disney Concert Hall.

Ronald W. Burkle Foundation

Burkle is the founder and chairman of The Ronald W. Burkle Foundation. The foundation’s mission is to create a positive global impact by supporting programs that enhance international understanding, promote workers’ rights, empower underserved communities, foster the arts and architecture, engage children in education, and advance scientific research.

Board Memberships

Burkle serves as co-chairman of The Ronald W. Burkle Center for International Relations at UCLA, which promotes research and dialogue on international relations, U.S. foreign policy, and global cooperation and conflict.

The Center has hosted notable figures, including former UN Secretary-General Ban Ki-moon, and U.S. Presidents Bill Clinton and Jimmy Carter.

He is also a trustee of The Scripps Research Institute, The Carter Center, the National Urban League, the Frank Lloyd Wright Building Conservancy, and AIDS Project Los Angeles.

His previous board memberships include roles with the J. Paul Getty Trust, the Los Angeles County Museum of Art, the Los Angeles Music Center, the John F. Kennedy Center for the Performing Arts, and the Museum of Contemporary Art, Los Angeles.

Fundraising Events

Burkle regularly hosts fundraising events for Share Our Strength’s No Kid Hungry campaign, which aims to eliminate childhood hunger in the U.S. Additionally, he holds events at his Greenacres Estate in support of The Rape Foundation.

Personal Life

Burkle has a strong interest in historic architecture. In 2011, he purchased the Ennis House, a renowned Los Angeles landmark designed by Frank Lloyd Wright, which was partially restored.

He later sold the property in 2019 for $18 million. Additionally, Burkle owns Greenacres, a historic estate originally built for actor Harold Lloyd.

He also acquired two properties once owned by entertainer Bob Hope, a Palm Springs home designed by John Lautner for $13 million in 2016, and a Toluca Lake residence originally designed by Richard Finkelhor in the 1930s, later expanded by John Elgin Woolf in the 1950s, for $15 million in 2017.

In December 2013, Burkle made headlines by purchasing an Olympic gold medal won by Jesse Owens at the 1936 Berlin Games for $1.4 million. He also owns the Nobel Prize for Literature awarded to William Faulkner.

Burkle owns a Mediterranean-style mansion overlooking the bluffs of Black’s Beach in the La Jolla Farms neighborhood of San Diego. He bought the nearly six-acre estate in 1999 for $15.3 million, and it is currently valued at $34 million.

In the realm of sports, Burkle has collaborated with Novak Djokovic, the world’s top-ranked tennis player at the time, on strategic marketing and charitable efforts.

In December 2018, Burkle was appointed honorary consul of Serbia in the U.S. when the Serbian Government opened a consulate in Montana.

He applied for and was granted Serbian citizenship on November 25, 2019, becoming the third Serbian billionaire on Forbes’ list.

Tragically, on January 6, 2020, Burkle’s son, Andrew, was found deceased in his Beverly Hills home.

In December 2020, Burkle, who had been a family friend of Michael Jackson, purchased the singer’s former Neverland Ranch for $22 million, viewing it as a “land banking opportunity.

Controversies

In April 2006, Burkle accused New York Post columnist Jared Paul Stern of attempting to extort money from him in exchange for halting the publication of damaging stories in the paper’s Page Six gossip column.

Burkle secretly recorded two meetings with Stern, the second of which was monitored by the FBI. Stern allegedly requested a $220,000 investment in his clothing business in return for better coverage. Following this, Stern was fired by the New York Post.

On April 30, 2008, a Delaware judge dismissed Burkle’s lawsuit against Raffaello Follieri, the former boyfriend of actress Anne Hathaway. This came after Follieri agreed to repay a $1.3 million loan from Burkle related to the Follieri scandal.

By 2018, Follieri, who had been deported to Italy after serving prison time for the scandal, revealed that he and Burkle had reconciled.

Follieri mentioned that Burkle was part of a group of investors helping him acquire a 50% stake in the Foggia Calcio soccer club in southern Italy.

Burkle’s name also appeared in the black book of financier Jeffrey Epstein and on his private jet log. Burkle was known to have taken trips with Bill Clinton to Africa aboard Epstein’s private Boeing 727, often referred to as “the Lolita Express.” After these trips, Burkle allegedly expressed discomfort, referring to Epstein as “creepy” and returning home via commercial flights.

Conclusion:

Ronald Burkle’s story is one of strategic investments and remarkable success. As a businessman with an eye for profitable opportunities, his legacy goes beyond financial achievements to include a range of philanthropic contributions.

His influence in business, media, and even sports continues to grow, marking him as one of the most versatile figures in American entrepreneurship.

Burkle’s life offers valuable insights for aspiring entrepreneurs and investors, showcasing the impact of vision and strategic thinking.